Today's Guest Speaker is W (not that one). He wanted to explain the fallacy of "Balanced" state budgets. Since he can't get anyone to listen to him without bribery or a blind eye, I thought I'd give him the floor.

W (not that one)- Because this is an election year, many states are campaigning for more federal money, and simultaneously boasting of how, unlike Washington, they nobly "balance" their budgets. Speaking recently on NPR, Governor Ted Strickland of Ohio, whose deficit will be about $1 billion this fiscal year, said his state urgently needed emergency aid from Washington. In the same interview Strickland complained about the federal deficit, declaring, "The federal government needs to become fiscally responsible." This points to a leading fallacy of American politics: the notion that states responsibly have balanced-budget requirements, while the federal government is the cause of all government deficits. Michael Dukakis in 1988, Bill Clinton in 1992 and George W. Bush in 2000 all boasted during their presidential runs that, as governors, they "balanced" their states' budgets. What nonsense! Most state budgets are "balanced" only in the sense that Washington gives large sums to state governments, shifting deficit spending upstream to the federal level.

In fiscal 2007, the federal government handed out $232 billion in routine operating grants to state governments -- a figure that excludes federal payments for Medicaid, a federally imposed but state-administered entitlement, and excludes special federal hurricane aide to Mississippi and Louisiana. The fiscal 2007 federal deficit was $163 billion. That is to say, if the federal government had not rained money on state houses, Washington's books would have shown a surplus rather than a deficit in the latest fiscal year. So the "fiscally responsible" thing for Washington to do would be to stop giving money to the states! Ohio, for example, received $6.2 billion in other-than-Medicaid federal money in fiscal 2007, toward an other-than-Medicaid state budget of about $31 billion. This means about 20 percent of the Buckeye State budget was billed to the federal taxpayer, making it appear Washington was overspending while Columbus was being careful and cautious with money. The same applies to nearly every other state, where only federal gifts make state budgets appear "balanced."

The situation is basically a bookkeeping swindle. Today federal taxes seem excessive, while state taxes seem affordable, because state taxes don't pay the full cost of state government, while federal taxes fund considerably more than the cost of federal government. The bookkeeping switcheroo makes the federal government appear less cost-effective than it actually is, while causing state governments to appear more prudent in their spending than they actually are. For instance, since the early Ronald Reagan presidency, state government employment has been rising while federal government employment has been declining; yet because states bill so much of their costs to Washington, people think the states are cautious about money while Washington is spendthrift. If states simply raised all their own revenue, federal taxes would decline, the federal deficit would vanish, and state taxes would skyrocket. Then voters would be mad at governors while objecting less to Washington.

California projects a $16 billion deficit in fiscal 2009, much worse per capita than New York, with an expected $5 billion fiscal 2009 shortfall, or Arizona, at a projected $2 billion. Yet California has not taxed itself to cover the problem, expecting instead a federal bailout. When times were flush and tax revenues high from 2003 to 2006, California, New York, Arizona and other states now short of money did not save for a rainy day: They spent freely, and now demand that someone else cover the bill. So far, only Maryland has done the manly thing: raising state taxes to pay off its deficit on its own.

Thanks W (not that one) and Happy Earth Day, to you.

Oh! affordable state taxes? What state do you live in (or county for that matter)? Oh yeah; you live in a commonwealth. Federal government employment declining is a fallacy. All the federal government has done is stop hiring their own employees and outsourced those jobs to the private sector, which is good for you and me. However, the money is still spent albeit not on benefits/health plans (go figure).

What remaining positions there are in federal government, a good deal of them are administrative folks with titles like "Technical Monitor" with inflated salaries that see over the contractors and make sure that they are dotting their i's and crossing their t's. Then they inevitably find fault with the contractor, put the contract out for RFP, and start the process all over. This process justifies their employment. Great gig, heh? Have you seen the prevailing wage determination tables for government outsourced positions? Those gigs are nice too. They certainly don't fall in line with any other private sector jobs. And you should see the benefits those employees are guaranteed, right out of the gate.

.jpg)

4 comments:

I didn't write the e-mail you posted Theo. The credit goes to Greg Easterbrook of ESPN, better know as the Tuesday Morning Quarterback or TMQ, hence the title of my e-mail to you, "TMQ for President".

Oh;

1) I thought it meant "Too Many Questions for President" and

2) that you didn't know which spelling of the word too to use. (Refer to aleikat.blogspot.com / Thursday, April 17, 2008 / Triple Deuce).

I should have known that you would not write something that good.

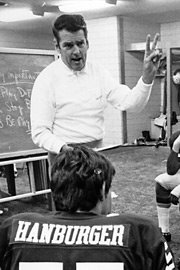

I can't stop laughing; that's one fly picture Big Dub

How do you like the inadvertant jug handle on his noggin, formed by the coat hook?

Post a Comment